To create a real forex account for free, click here

High-frequency trading (HFT) is a relatively new phenomenon in financial markets. It gained popularity in the 2010s and remains popular to this day.

This article describes in detail how high-frequency traders operate. You’ll learn when the HFT strategy was created, who was the first to use it, and whether HFT has become an integral part of everyday trading. The article also lists the most popular high-frequency trading strategies. How to become a high-frequency trader? What does it take to write such an algorithm and then make it work? Is HFT strictly regulated? Read on to find out the answers to these and many other questions.

What is high-frequency trading (HFT)?

The trading process is constantly evolving. It all started with verbal agreements between buyer and seller. Then markets and exchanges appeared, most of which now conduct trading online.

In pursuit of speed of operations and profit, humanity is constantly inventing new ways to make money. This list includes HFT.

High-frequency trading (HFT) is a type of automated trading that is characterized by the high speed of execution of trading operations. Speed is ensured by powerful computers and servers located next to the exchange.

Of course, HFT cannot replace the traditional approach to investing, where a few days to several months pass after opening a trade. HFT is rather an additional opportunity that allows you to earn money where there was none before.

High-frequency Forex trading is not for everyone. At this stage of technology development, powerful and expensive equipment is required. To execute 100 trades per second, you need high-speed Internet. This requires a large investment and an agreement with the exchange to place the equipment as close as possible to the main computer (preferably on the same trading floor). Renting space next to the exchange server also costs a lot of money.

That is, if you do not have tens of millions of dollars, HFT trading is not for you. Typically, these types of strategies are used by large institutional investors and hedge funds.

In addition to costs, high-frequency Forex trading requires special software and a trading strategy. They are not publicly available, since they are developed individually by programmers who are able to write a working and effective algorithm.

However, is high-frequency trading really inaccessible? Maybe there is something in the strategy that you can use in your trading systems. Below, you will learn what high-frequency Forex trading is and how ordinary traders can use it.

Characteristics of high-frequency trading

Let’s consider the main characteristics of HFT algorithms. The United States Securities and Exchange Commission (SEC) singles out seven signs of high-frequency trading:

- requires high-speed hardware and sophisticated software for order generation and execution;

- the time frame for placing, changing, or canceling an order, as a rule, does not exceed five milliseconds;

- colocation services for equipment placement are located as close as possible to the main exchange server. This allows you to minimize the time lag and reduce the number of potential requotes;

- placing a large number of orders, which can also be quickly canceled;

- ending the day without open positions, if possible;

- the predominance of ultra-fast orders in the final order portfolio (more than 50%).

The SEC does not define high-frequency trading, but only names the general features of this approach. This is due to the difficulties of regulating the industry. In some countries, for example, China, Brazil, partly in India and others, HFT is prohibited.

To summarize, all HFT strategies have high execution speed and a large number of orders, and require sophisticated software and high-performance hardware.

High-frequency trading history

The history of HFT began at the end of the 20th century, when electronic trading platforms and the Internet appeared. One of the first examples of HFT was the SOES Bandits trading strategy, which used the Small Order Execution System for NASDAQ stocks. SOES Bandits exploited the price differences between market makers and retail investors, profiting from short-term price fluctuations.

The creation of high-frequency trading is also associated with the name of Steven Swanson, a young programmer who decided to apply his knowledge to the stock market. Together with colleagues David Whitcomb and Jim Hawkes, he founded Automated Trading Desk (ATD).

ATD developed BORG (Brokered Order Routing Gateway). With the help of this system, data on the quotes of a particular stock enters the computer via satellite Internet. A special algorithm then makes a forecast about the price movement of this stock in the next 30-60 seconds. If the forecast coincided with the conditions, the system automatically placed an order to buy or sell the asset.

As a result, it became possible to complete transactions in a matter of seconds. By 2006, the company was trading 700-800 million shares per day. More than 9% of all US stock trading volume came from the Automated Trading Desk. Around that time the company got competitors, Getco and Knight Capital Group.

At the beginning of the 21st century, high-frequency Forex trading became more widespread and more complex. Traders began to use more advanced algorithms, mathematical models, artificial intelligence and machine learning. In addition, high-frequency traders began to compete for data transfer speeds by placing equipment closer to exchange servers, using dedicated communication lines and satellite channels.

The list of the most famous HFT strategies of the beginning of the current century includes market making, arbitrage, statistical arbitrage, momentum ignition, spoofing (imitation of a buy/sell order) and layering. All of these strategies, in one form or another, still function today.

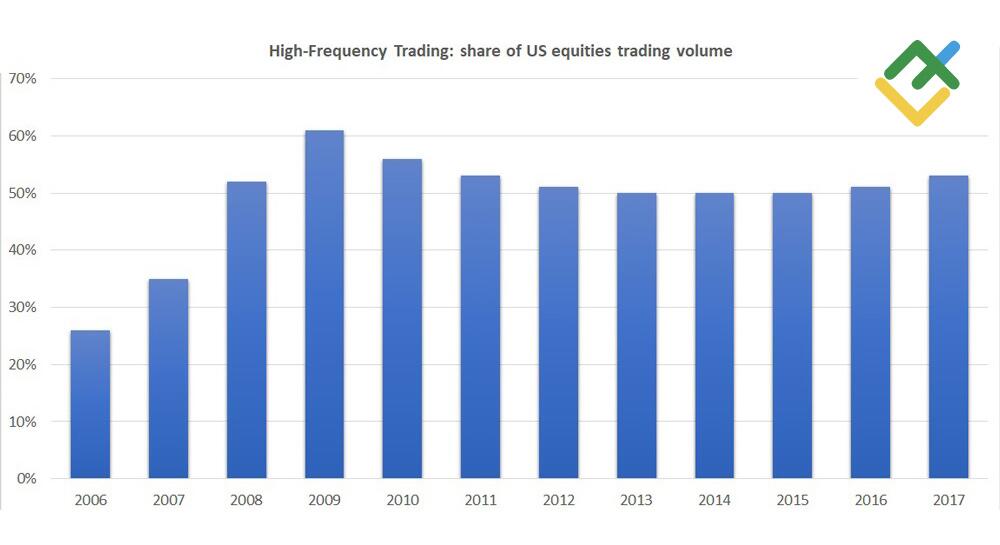

HFT reached its peak in 2009, when it accounted for about 60-70% of all trading volume in the US stock market. At the same time, high-frequency trading became the subject of criticism from the public and the attention of regulatory authorities, since it was associated with a number of negative phenomena. For example, front running or price manipulation, flash crashes and increased market volatility. HFT is also associated with scandals such as the 2010 Flash Crash, the publication of Michael Lewis’s Flash Boys, and the fraud charges against HFT company founder Navinder Sarao.

Over time, the HFT strategy has become less profitable and popular. The main reasons for this are tightening regulation, increased competition, decreased liquidity and margins. According to TABB Group, HFT’s share in the US fell to 50% in 2012 and to 40% in 2019. Some HFT companies have gone out of business, merged with others, or sought new opportunities in emerging markets and other asset classes. High-frequency Forex trading is still a significant part of the financial services industry, but it is not as dominant or innovative as it once was.

High-frequency trading volume and distribution

So, what is interesting about the HFT? How did this type of trading contribute to the emergence of hundreds of companies, millions of investments, and the emergence of the term “colocation”? Let’s figure it out.

19th-century banker Nathan Rothschild once said, “Who owns the information, he owns the world.” When Napoleon had the advantage at the beginning of the Battle of Waterloo, observers reported to London that the French were winning. The British rushed to sell shares in fear, confident that the war was lost.

However, Rothschild’s courier, John Roworth, watched the battle a little longer and saw Napoleon flee to Brussels. He asked a local fisherman to take him across the English Channel to be the first to report the defeat of the French to Rothschild.

Nathan Rothschild began selling company shares along with everyone else, cutting their prices as low as possible. At this time, his agents bought securities at low prices. As news of Napoleon’s defeat spread across London, stock prices soared. The Rothschild family earned around £40 million from this event alone.

In the 19th century, information received a few hours earlier could enrich one person while making poor people even poorer.

Thus, information about an important event, received before others, gives a huge advantage. In the 21st century, the speed of obtaining up-to-date information remains one of the most important components of successful trading on the stock exchange.

HFT robots are capable of receiving and processing information in a few seconds. The programs work so fast that people cannot compete with them. Before the information reaches the average trader, HFT companies will close hundreds of transactions and make a profit.

Due to the high speed of information processing, high-frequency Forex trading gained popularity in the 2000s. The first companies that used HFT algorithms earned hundreds of millions of dollars, which served as excellent advertising. By 2010, the volume of transactions of such firms increased by 2.6 times, and the speed of order execution increased to tens of microseconds.

Investment banks, prop firms, and closed-end funds began investing in the development of HFT algorithms and hiring teams of professional programmers. The United States has become the center of high-frequency Forex trading. Since 2008, HFT trading has accounted for at least 50% of the volume of the entire US stock market. Volumes peaked in 2009 at around 60%.

Then the Global Financial Crisis struck, many firms were forced to curtail investments in HFT trading strategies, and some went bankrupt. As a result, the share of high-frequency trading in the market began to decline and stopped at 50%. Approximately this percentage of HFT trading volume remained until 2016. Then it started to grow again.

According to TABB Group, HFT trading became widespread in Europe much later and was not as popular as in the United States. High-frequency Forex trading only began to develop in Europe in 2006, when in the US this method already accounted for about 25% of stock trading volumes. European trading volumes peaked in 2010, a year later than in the US. Since then, HFT volumes in Europe and the USA have been approximately the same.

Currently, the share of HFT trading in the markets of developed countries is about 50% and is declining slightly. This is due to increased attention from both the public and regulators. Many countries have banned high-frequency Forex trading at the legislative level. The US and Europe closely monitor such firms and apply strict measures against them, including ongoing audits and internal reviews of existing procedures to prevent market abuse. Competition has also increased, so the current profits from high-frequency Forex trading are much lower than in 2009-2010.

However, at present, this industry remains promising for the introduction of new mechanisms and developments. The rule “who owns the information, owns the world” still applies, which is why the investment departments of large banks continue to show interest in HFT.

Who uses high-frequency trading?

High-frequency trading in the Forex market requires writing complex and fast trading algorithms, expensive equipment and spending money on colocation. As a rule, only institutional investors have sufficient resources to use HFT trading. For example:

- hedge funds;

- large banks and investment structures, for example, insurance companies;

- independent firms specializing in the development and implementation of HFT;

- companies affiliated with brokers.

Companies wishing to gain access to the HFT market face the following challenges:

- purchase of high-performance computers;

- hiring a team of programmers specializing in high-level programming languages such as C++, Java, etc.;

- writing and testing trading algorithms;

- design optimization and installation of HFT equipment near exchange gateways using the FIX/FAST protocol;

- investing large sums of money.

Thus, the monopoly on high-frequency trading largely belongs to institutional investors. HFT requires corporate connections and a special market position, which is why it is often criticized by the public.

According to Wikipedia, the largest high-frequency traders in the US are Chicago Trading, Virtu Financial, Timber Hill, ATD, GETCO, Tradebot and Citadel LLC. These companies have advanced technologies, highly qualified specialists and access to large trading platforms. This allows them to use trading strategies such as market making, statistical arbitrage, news trading and others.

Why is high-frequency trading interesting for individual and institutional traders?

High-frequency trading allows major players to gain an advantage in exchange for providing liquidity. Millions of orders placed by high-frequency trading systems support the market, and those who use them become market makers. In return, HFT companies can get more favorable trading conditions and increase profits.

Thus, high-frequency trading satisfies both parties. An HFT company can gain an advantage that is based on volume. The profitability from each transaction is very small, so in order to make a significant profit, you need to complete a huge number of transactions. This, in turn, ensures that sufficient liquidity enters the financial markets.

HFT companies have two direct sources of income. The first is earnings on the spread for providing liquidity. The second is the reduced transaction fee that trading platforms provide. It is beneficial for trading platforms to reduce commissions and attract HFT companies because they increase market liquidity, thereby attracting ordinary traders.

This bilateral cooperation makes numerous financial markets efficient. However, first of all, each party is interested in earnings. Profits from high-frequency transactions remain high today, and the HFT field remains closed for new participants. This allows the same companies to share market profits year after year and achieve their investment objectives.

Let’s take a closer look at the ways to earn money using HFT strategies in the Foreign exchange market.

How high-frequency Forex trading works

High-frequency Forex trading is entirely dependent on the technology used. HFT trading is based on a powerful computer and sophisticated software. It is important for HFT traders to use the latest technology that can withstand the competition.

High-frequency trading is close to the usual trading advisors that can be used in any terminal, for example, MetaTrader. A classic advisor analyzes market data and, using built-in indicators, makes a decision to buy or sell an asset, which is implemented on the trading account. Next, the advisor looks for signals in the Forex market to close the position according to the algorithm. Traders are required to install and configure the advisor correctly, then monitor its operation and withdraw profits.

The high-frequency trading algorithm in the Forex market functions in approximately the same way. However, it has several differences:

- the speed of analysis and decision-making is hundreds of times faster than on a home computer;

- due to its speed, the HFT advisor opens several hundred orders and quickly changes or closes them.

Traditional automated trading relies more on the accuracy of analysis rather than speed of execution. In HFT trading, on the contrary, the most important thing is the speed of execution, while technical analysis is secondary. In high-frequency trading, investors profit from hundreds of high-volume trades, which require time to make decisions and low trading costs.

Main High-Frequency Trading Strategies

Earlier, you learned that HFT trading is an important part of market-making and is actively used in arbitrage. The emergence of high-frequency trading in the Forex market has caused significant changes in these areas, contributing to new earning strategies. Let’s look at the most famous high-frequency trading strategies large HFT firms use.

Statistical arbitrage

The HFT strategy is based on comparing prices for an instrument on different platforms, searching for differences in prices and subsequent short-term trades made with the expectation that prices will become equal.

For example, in city X, famous Converse sneakers cost $100. In city Y, the same sneakers cost $100.10. This creates an opportunity for arbitrage. You can buy sneakers in city X and go to city Y to sell them at a better price. From this price difference and the number of pairs of shoes sold, you will earn income.

In classical trading there are not many opportunities for arbitrage. Online trading of popular commodities is carried out all over the world. Thanks to the development of technology, information is updated very quickly, so for HFT systems this is an opportunity to make money. High-frequency trading allows companies to take advantage of this opportunity where the average person wouldn’t see it.

Let’s say that prices on the New York Stock Exchange lag behind prices on the London Stock Exchange by half a second. During this time, the euro exchange rate in New York will become higher than in London. A computer can take advantage of this and buy millions of dollars in euros in one city and then sell them for a profit in another. This is an example of statistical arbitrage.

Rebate arbitrage

Firms place a large number of passive orders on various exchanges using HFT software.

News arbitrage

An HFT strategy in which an algorithm analyzes news feeds and looks for price differences that appear when important news is released.

Market making

This strategy consists of maintaining liquidity in the market for certain instruments and controlling spreads in exchange for remuneration from an exchange or other structure, as well as favorable trading conditions.

Structural strategies

Structural high-frequency trading strategies eradicate inefficiencies in the interaction of the exchange with broker clients.

Directional Strategies

Such as spoofing and market manipulation are designed to induce aggressive traders to trade and then activate Stop Loss for a short time period in a narrow price range. It is considered an unethical money-making strategy.

Front-running

Front-running strategies involve identifying large orders and placing orders before them.

Spread Analysis

HFT strategies, in which the program looks for micro-trends within the spread.

This is not a complete list of HFT strategies. Only the most famous ones are presented here. It shows that the scope of high-frequency trading in the Forex market is quite extensive. In a trading strategy, speed and responsiveness are important, whether it is news trading or trading within the spread. Many HFT company strategies are not open to the public. It’s logical. You should not give away the secret of making money as long as it works stably and makes a profit.

The video below shows quotes and trades from nine exchanges in less than one second, as well as Apple Computer Corp. shares SIPs. The algorithm was used in 2013.https://www.youtube.com/embed/hjBQ3Lv8yR8?rel=0

During the height of this high-frequency trading algorithm’s popularity, many Apple stock options were executed at lower prices as sudden price movements caused huge numbers of option quote updates (more than 200,000 per second). Because of this, many systems simply could not keep up with this algorithm.

High-frequency trading software

High-frequency trading (HFT) is a type of algorithmic trading in which trades are opened and closed very quickly and frequently using specialized programs and high-speed communication channels.

For successful HFT trading, you must have access to trading terminals that provide fast execution of orders, low latency (delay to the exchange server), high performance and stability. It is also important to choose suitable advisors that implement effective HFT strategies. Below are the trading terminals that are suitable for HFT trading:

- ATAS is a trading platform for analysis and trading on futures markets. It provides various tools to visualize volumes, deltas, spreads and other parameters. ATAS also allows users to create and run their own C# advisors;

- TigerTrade is a multi-broker platform for trading on exchanges in Russia, the USA, Europe and Asia. TigerTrade has a built-in block-based advisor designer. The platform also supports integration with external channels via API;

- CScalp is a free terminal for scalping on stock markets. It has high speed, low Internet connection requirements, and a simple interface. The terminal allows users to connect with third-party advisors via API;

- Coinigy is a trading platform for trading cryptocurrencies on different exchanges. It offers a convenient graphical interface, a variety of indicators and analysis tools, as well as the ability to create and run your own Python advisors;

- TradingView is a popular platform for analyzing and trading on various financial markets. It has a powerful graphics engine and a large historical database. The platform supports the creation and launch of your own Pine Script advisors.

Below are the advisors for high-frequency trading in the Forex market:

- Quantum Emperor is an algorithmic trading robot that uses a machine-learning strategy based on neural networks. The advisor analyzes a large amount of data and determines the optimal entry and exit points;

- HFT Prop Firm EA is an advisor that uses a statistical arbitrage strategy. It tracks correlations between currency pairs and opens trades when deviations from the average occur;

- Quantum Trade EA is a high-frequency trading strategy that uses the scalping method. The advisor opens and closes trades within a few seconds using trend, volume and volatility indicators;

- XAUUSD scalper M1 is an advisor that specializes in gold trading. It uses a scalping strategy based on analysis of price action and support/resistance levels;

- HFT Spreader for FORTS is an advisor for trading in the Russian futures market, which uses a trading strategy within the spread in the order book. It analyzes the difference between the purchase and sale prices of different instruments and opens transactions under favorable conditions.

High-frequency Forex trading is difficult for new traders. To trade successfully, you need to have a powerful PC and a very fast Internet connection and an uninterruptible power supply. If the power goes off and you don’t have a UPS, you’ll quickly lose money.

Algorithmic HFT trading is used by the largest fintech companies, which retail traders cannot compete with. The company will always have better conditions, namely direct market access, speed, finances, and programmers’ staff. Do not use the above advisors for Forex trading without a clear understanding of what you are doing.

Programming languages

High-frequency Forex trading programs are more complex than the advisors used by regular traders. Simple advisors are usually written in the Java programming language or MQL by MetaQuotes. They allow you to scalp the market and engage in Forex trading, but are not suitable for operations executed in milliseconds or microseconds.

HFT professionals most often use several programming languages on the basis of which a program or several programs operate, each of which is responsible for its own function. Below are the most commonly used HFT programming languages:

- Python is primarily used for quantitative analysis;

- R is often used for statistical analysis and data analysis;

- C++ allows users to create faster program structures.

Insiders have also reported the use of Java, Matlab, and C# in high-frequency trading.

The most crucial aspects of a high-frequency trading program are speed and optimization. Companies that react more quickly to changes in market conditions will have an advantage and, consequently, greater profitability.

Low-frequency vs. high-frequency Forex trading

Low-frequency trading is called manual trading or trading using advisors, where the transaction time is measured from a few seconds to infinity. In high-frequency trading, orders are placed, modified and closed within milliseconds or microseconds.

In other words, everything that does not have signs of high-frequency trading is classified as low-frequency trading. Retail traders’ trading is low-frequency trading. Forex trading, in which a trade is opened and closed within a day, is also low-frequency.

Low-frequency trading does not require super-fast software or huge computing power. In this case, traders must independently analyze the market, look for patterns, and also develop their own trading system that would meet their goals and capabilities. In high-frequency trading, the most important thing is the speed of order execution and a unique algorithm that quickly looks for patterns, compares a lot of market data and makes a decision.

Until recently, all trading could be called low-frequency. High-frequency trading only emerged with the advent of Internet trading and electronic exchanges. Now it’s an entire industry that, for the most part, is not open to everyone. You can only get into it if you have connections, money and talented programmers.

However, this does not mean that low-frequency trading is unprofitable. High-frequency Forex trading involves high stakes and significant risk, as well as constant checks and pressure from regulators. By trading using your abilities, you can achieve outstanding profitability results. Sometimes, in percentage terms, it is even greater than with high-frequency trading.

High-frequency trading advantages

High-frequency trading in the Forex market has advantages and disadvantages. Let’s take a closer look at them.

HFT generates income through speed, automation and high trading volumes

HFT algorithms are able to identify micro-trends and their changes earlier than others. Thanks to a high-speed communication channel, programs can send hundreds of trading orders per minute directly to the exchange server. No other trading system is capable of this.

The sooner the algorithm finds a suitable pattern for trading, the more favorable prices it will open a trade with and earn more than others. Thanks to the ability to open orders in large volumes, hundreds of trades per minute will bring tangible income, even if the price movements were insignificant.

HFT provides liquidity in financial markets

Another advantage of HFT is the market-maker function. A large number of buy and sell orders form the market and support it. The spread between Bid and Ask prices narrows, and more regular traders and trading companies enter active markets.

As a result, the exchange transfers market maker functions to HFT companies, and traders enter a highly liquid market and enjoy a low spread. HFT organizations enjoy reduced trading commissions and, in most cases, receive additional cash rewards for market making.

No human factor

Since all actions of the program are strictly regulated and specified in the algorithm, typical human errors associated with fear or greed are excluded. The program will open trades only where necessary and only when market conditions allow it. This allows traders to make a stable profit.

However, errors in the code and other associated risks cannot be excluded, so the process must be controlled by a person in any case.

HFT pros and cons are presented in table form below:

| Advantages | Disadvantages |

| Market liquidity support | Possible market manipulations |

| Lower spreads | Getting money out of nowhere |

| Reduction of traditional arbitration | Errors in the code can lead to fatal consequences |

| Not affected by sudden price increases because transactions are carried out in milliseconds | Makes markets more volatile |

| Minimal human involvement | Not available to individuals and small organizations |

| High profitability |

Critiques of high-frequency trading

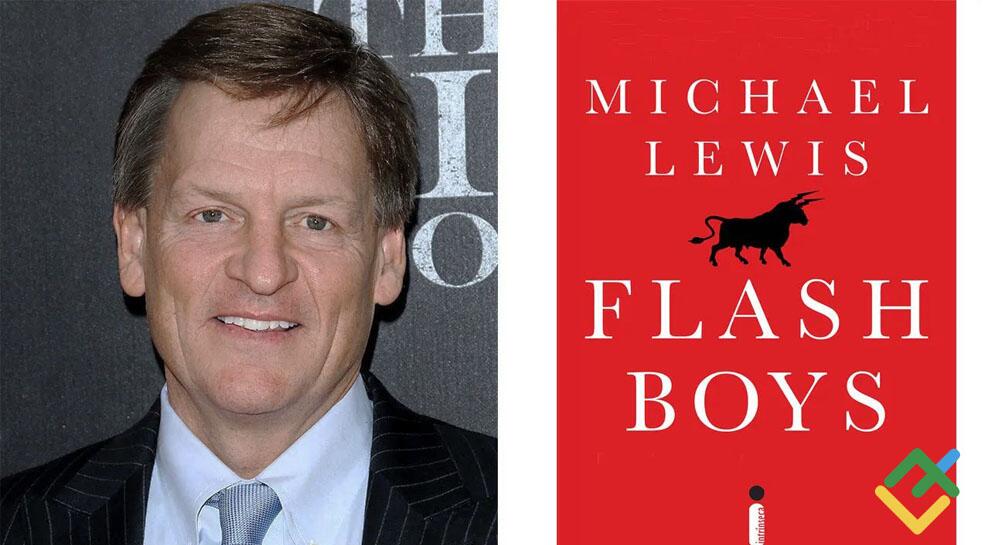

In the last decade, many influential investors have criticized HFT algorithms. Michael Lewis’s book, “Flash Boys: A Wall Street Revolt”, caught particular attention. The author argues that the US stock market is being manipulated by high-frequency traders using front-running and algorithmic trading.

Sales of “Flash Boys” in the first week after publication exceeded 130 thousand copies. The book instantly gained popularity among the American population, which lost some or all of its retirement savings in 2010 due to the stock market crash. The day after the start of sales, the FBI began an investigation into high-frequency trading.

Some critics noted that Lewis should have done more research on the topic and that his portrayal of stock market trading was too gloomy. In general, all the claims of the investment community against HFT are as follows:

- Due to the speed of trades, HFT revenues are very difficult to track. In this way, billions of dollars are distributed among rich people, making them even richer. Information about this remains within exchanges and closed trading firms;

- Due to their advantages, HFT companies profit from the losses of mutual funds in which ordinary people keep their retirement savings, which makes poor people even poorer;

- Failures in the operation of HFT algorithms can lead to a stock market crash similar to May 6, 2010. The fall of the S&P 500 index that day amounted to 998.5 points in a few minutes and was later described as a failure of the HFT algorithms.

To understand what failures in a high-frequency trading system can lead to, let’s take a closer look at the 2010 flash crash. After all, the share of HFT in the financial markets of the USA and Europe is about 50%.

The Flash Crash that occurred on May 6, 2010, also known as the “2:45 Crash,” resulted in short-term losses of $1 trillion. It began at 2:32 pm Eastern Time and lasted approximately 36 minutes.

American stock indices such as the S&P 500, Dow Jones 30, and NASDAQ Composite collapsed and recovered within a matter of minutes. This was the second-largest intraday point swing in the history of the S&P 500. Prices for stocks, stock index futures, options, and exchange-traded funds (ETFs) were highly volatile that day, causing trading volume to soar. A 2014 CFTC report described the day as one of the most turbulent periods in the history of financial markets.

Subsequent investigations determined the causes of the collapse. British Indian financial trader Navinder Singh Sarao purchased commercially available trading software. He later modified it to quickly place and automatically cancel orders.

On May 6, 2010, US stock markets opened, and the S&P 500 fell amid concerns about the Greek debt crisis. At 2:42 pm ET, after the S&P had already dropped more than 300 points for the day, the stock market began to fall rapidly, losing 600 points in 5 minutes. As a result, it fell by 1000 points by 14:47. Twenty minutes later, the market had recovered most of the decline and was up 600 points. Other stock indexes mirrored the S&P 500’s moves.

Just before the crash at 2:42 pm, Navinder Sarao placed orders for thousands of E-mini S&P 500 stock index futures contracts, which he planned to cancel later. About $200 million worth of orders were placed and then replaced or modified 19,000 times before they were canceled. This caused an imbalance in the system and provoked other traders to open short trades. As a result, demand disappeared, but supply remained, which led to an instant collapse.

In May 2014, a CFTC report concluded that high-frequency traders did not cause the flash crash but contributed to it by claiming priority over other market participants. On April 21, 2015, almost five years after the incident, the US Department of Justice filed 22 criminal charges, including fraud and market manipulation, against Navinder Singh Sarao.

Journalist John Bates of Traders magazine later said that blaming the 36-year-old small-time trader, who worked out of his parents’ home in suburban West London, for the trillion-dollar stock market crash was “a bit like blaming lightning for starting a fire.”

Presumably, in addition to Sarao, other high-frequency traders were also involved in the collapse. Many market participants are still confident that the real criminals who made huge amounts of money from this have never been found. This money was taken from ordinary people’s pension savings. Subsequently, many retail investor accounts were destroyed.

Dark pools role

Dark pools in HFT trading is an interesting topic that deserves more detailed consideration. Dark pools or hidden liquidity pools are trading platforms for anonymous electronic trading of large volumes of securities that are not visible on public markets.

In other words, dark pools are private exchanges where institutional investors trade large volumes with each other without having to disclose the details of the transaction to the wider market. This also means that transactions conducted in dark pools bypass the servers used by HFT algorithms.

Liquidity pools are not new to the market. Closed private exchanges have been known since the 1960s. Statistical data concerning them is rarely leaked to the public. However, trading volume in such dark pools is believed to have increased recently, while high-frequency trading volume in public markets has fallen.

This relationship is easy to explain. The ability to trade large volumes in dark pools without causing large price movements means that high-frequency traders have less ability to execute large trades in public markets. This, in turn, leads to greater emphasis on lower volume trades, which high-frequency trading is not designed for. Previous flash crashes or sharp price movements caused by high-frequency trading have only increased the appeal of dark pools to institutional investors.

This phenomenon also has the opposite effect. The less liquidity there is in public markets, the more interested the trading platform is in the emergence of new HFT firms. Accordingly, the attractiveness of creating HFT algorithms and their use is increasing.

The growing pressure on high-frequency trading has led to the consolidation of companies within the sector to counter higher costs and tougher market conditions. While most high-frequency traders are privately held, there are some publicly listed companies involved in the industry, such as Citadel Group, Flow Traders and Virtu Financial.

Disadvantages of dark pools include low transparency, unequal access, and the possibility of market manipulation.

High-frequency trading regulation

As a result of increasing stock market disruptions, the 2010 Flash Crash and public outcry, financial market regulators in the US and Europe decided to introduce rules to provide clarity in the regulation of the HFT industry.

The problem with regulating this industry is that e-commerce is allowed and legal. Firms using HFT algorithms are trying to convey to regulators that high-frequency trading in the Forex market is the same as electronic trading, only faster. They believe that there is nothing wrong with using high computer power and fast communication channels. However, sharp fluctuations in asset prices, high profits out of nowhere and cash losses from investment funds that cannot accommodate HFT and which hold taxpayers’ retirement savings are forcing governments around the world to take control of the high-frequency trading industry.

There are European and American approaches to regulating HFT:

- The Financial Instruments Directive and the Financial Instruments Directive II, which clarify the definitions of high-frequency trading, are in force in the EU. Almost all market participants must be authorized by authorities, and high-frequency traders must maintain records of their trades and algorithms for a minimum of five years;

- In the US, the Financial Industry Regulatory Authority has introduced the same rules as in Europe, but they are more focused on mitigating the effects of high-frequency trading. Additional rules have been developed for how firms manage order flow. There are rules that help limit spoofing, false quoting, and exorbitant influence.

Following the 2010 financial crisis, the US Congress passed the Dodd-Frank Act to regulate high-frequency trading. One of its chapters is entirely devoted to high-frequency trading. After the 2010 flash crash, the SEC and the Department of Justice began investigating and dedicating resources to combating fraud and market manipulation.

In France, the financial industry regulator has established certain obligations for HFT platforms:

- they must have sufficient power to process orders generated by high-frequency trading systems;

- they must ensure minimum delays to be able to monitor and detect activity that could lead to abuse of markets;

- they must be able to monitor transactions carried out by participants and users, as well as open and canceled orders that could be used to manipulate the market.

HFT trading is banned in China, as Chinese exchanges enforce very strict restrictions on the frequency and volume of trades, and charge high cancellation fees. They do not provide direct access to trading and do not host their equipment in the same data center as HFT companies, which increases the delay in data transfer. This makes HFT trading impossible or unprofitable in the Chinese market.

In India, HFT trading is permitted but is regulated by the Securities and Exchange Board of India (SEBI). It introduces various regulations and requirements for HFT traders. For example, in 2016, SEBI set a minimum order lifetime of 0.5 seconds and also required HFT traders to use a special code to identify orders. In 2017, SEBI also proposed to introduce a competitive auction system to distribute trading access among HFT traders.

Different countries have different approaches to regulating HFT trading, from a complete ban to no restrictions. Developed countries are trying to regulate the HFT industry to take care of citizens who are new to trading but who invest, for example, in pension funds.

Conclusion

High-frequency trading has become one of the main ways to make money in the financial markets. Due to their speed, HFT algorithms are capable of generating a lot of money in short periods of time.

Naturally, to implement a high-frequency algorithm, large investments are needed, which will be spent on software development and optimization, the purchase of powerful computer components and the rental of space next to the exchange server. However, judging by the number of high-frequency firms and their share of the stock market, these investments are well justified.

The rule “who owns the information owns the world” still applies today. The race for speed and power will continue in the future, so competition among HFT firms will increase. As a result, new trading strategies will appear.

High-frequency algorithms can also fail, which can lead to flash crashes, such as in 2010. After the incident, regulatory authorities and financial ministries of all countries of the world began to monitor the HFT industry. Some countries have introduced regulations or bans, while in others everything has remained unchanged. However, progress cannot be stopped artificially, so high-frequency trading will definitely be around for a long time.

To become a high-frequency trader, you need to have great financial resources. Therefore, this type of trading is not available to ordinary traders. However, you can make quite a decent living from short-term or medium-term trading,

High-frequency traders can automate their trading using accessible programming languages and trading advisors. Such automation will not interfere with HFT, but will free up time for market analysis and personal affairs, while maintaining income levels.

To create a real forex account for free, click here