To create a real forex account for free, click here

What is forex?

Forex is short for foreign exchange (sometimes abbreviated to just FX) and is the global, decentralized trading market of the world’s currencies. Traders, investors, banks and exchanges buy, sell and speculate on these currencies, and in turn this activity determines the foreign exchange rate.

What is forex trading?

In forex, all trading is carried out through the so-called ‘interbank’ market. This is an online channel wherein the trading of currencies is conducted 24/5. Some estimate that the total daily trading volume is $5 trillion – making it one of the largest trading markets in the world.

What do forex brokers do?

Like all brokers, a forex broker acts as an agent helping traders access the interbank that conducts all forex trading. Alpari International is one of the most well-known forex brokers in the world. We provide different options tailored to the many different clients that we look after. Whatever your trading goals are, our range of accounts are designed to work with every objective. You can check out our different forex trading accounts here and if you’re only just starting, we suggest you open a demo account to start practicing how to trade without risking any real money.

What are currency pairs?

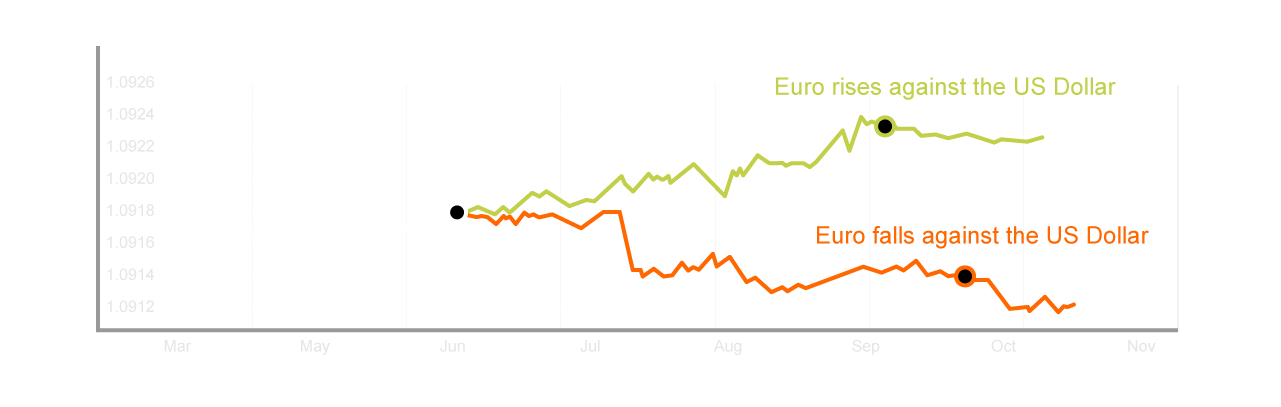

Forex is all about speculating on the fluctuating currencies between two countries. These two currencies are referred to as ‘currency pairs’ and they’re made up of the base currency and the quote currency. The most traded currency pair of all is the Euro against the US Dollar, which is normally presented as EUR/USD.

What’s an ask price?

This is the price that a trader would ask for when selling the currency pair. The ask price also changes constantly and is driven particularly by market demand, although it’s also susceptible to economic and political factors.

How does forex trading work?

To trade forex is to buy and sell currencies – with the aim of making a profit. Forex trading will always involve two currencies at a time, the base currency and the quote currency. The difference in price is where you’ll make your profit or loss.

Is forex trading risky?

Any kind of trading has its risks and that’s crucial to always keep in mind, but it can also create profits which is why so many people do it. Again, we can’t encourage you enough to start trading on a demo account if you’re new to forex trading. Once you’re ready for a live account, you should always fully consider the risks involved.

What is a position?

A position is a trade which is currently in progress. In trading, you can get long positions and short positions:

- Long position: this is when the trader has bought a currency with the expectation that it will increase. Once the currency is sold back, the long position is considered closed.

- Short position: this is when the trader has sold a currency with the expectation that it will decrease. Once the currency is bought back, the short position is considered closed.

What currency pairs are most popular in forex trading?

While you can trade almost any currency pair in theory, there are certain pairs that are consistently the most traded. These are called Major pairs (it’s in the name) – they make up 80% of the entire trading volume in the forex market.

These major pairs are associated with stable economies and therefore offer low volatility and high liquidity. Example of major pairs include the aforementioned EUR/USD, the USD/JPY (the US Dollar and the Japanese Yen), GBP/USD (British Pound and the US Dollar) and the USD/CHF (the US Dollar and the Swiss Franc). Another characteristics of major currency pairs is that there’s a smaller risk of them getting manipulated and the spreads are usually pretty small.

What are cross currency pairs?

Cross currency pairs are also known as Crosses, and are pairs that do not include the US Dollar – which immediately makes them more volatile and less liquid than Majors. While the US Dollar features in every major pair, Crosses are concerned with more ‘minor’ currencies like the EUR, the GBP and so forth. Popular pairs in the Crosses family include the EUR/GBP, the GBP/JPY and the EUR/JPY.

What are exotic pairs?

Exotic pairs – or just Exotics for short – are those currencies that come from smaller economies and the so-called emerging markets. They’re usually paired up with a major currency. Because these offer the least amount of liquidity and the highest volatility of the three brackets, they are regarded as the riskiest to trade.

Examples include USD/MXN, GBP/NOK and CHF/NOK.

What are the abbreviations for the most common currencies?

For ease, forex relies on abbreviations for the various currencies. Here’s a sample of the most talked about ones:

EUR:Euro

USD:US Dollar

JPY:Japanese Yen

GBP:British Pound

CHF:Swiss Franc

AUD:Australian Dollar

CAD:Canadian Dollar

NXD:New Zealand Dollar

MXN:Mexican Peso

NOK:Norwegian Krone

DKK:Danish Krone

CNY:Chinese Yuan Renminbi

What are the nicknames for all the pairs?

In forex trading, the various combinations of currency pairs have developed their own nicknames. Some are self-explanatory, some have historical relevance. Check them out below:

MAJORS:

EUR/USD“Fiber”

USD/JPY“Gopher”

GBP/USD“Cable”

USD/CHF“Swissie”

AUD/USD“Aussie”

USD/CAD“Loonie”

NZD/USD“Kiwi”

MINORS:

EUR/GBP“Chunnel”

EUR/JPY“Yuppy”

GBP/JPY“Guppy”

NZD/JPY“Kiwi Yen”

CAD/CHF“Loonie Swissy”

Forex charts

A lot of forex trading will use charts to demonstrate movements within the markets. These will usually involve one of three types of chart: the Japanese Candlestick, the Bar and the Line.

The Japanese Candlestick Chart,

or Candlestick Chart for short, conveys a lot of information, making it one of the most popular charts for forex traders. With the simplest components, traders can see the high, low, opening and closing prices on a candlestick chart.

These charts have three points – the open, close and the wicks. The wicks represent the high to low range, and the wide section will explain whether the closing price was higher or lower than the opening price. If it closed higher, the candlestick will be filled. If it closed lower, the candlestick will be empty.

The Bar Chart

shows the opening, closing, high and low of the currency prices. So the top of the bar shows the highest price paid, while the bottom shows the lowest price traded during that particular length of time.

The bar itself is indicative of the currency pair’s trading range, while the horizontal lines show, on the left, the opening prices and, on the right, the closing prices.

The Line Chart

is the simplest of all three graphs, which is why forex beginners love them and advanced traders tend to use Candlesticks or Bars. The line chart simply shows the price movement of a currency pair – by having a line drawn from one closing price to the next – during a specified length of time.

How do I start forex trading?

Newcomers to forex trading should always use a broker who is a) regulated and b) has a five-year track record, minimum. With trading, you will need to deposit funds to make the first trade, in what is called a margin account. Needless to say, you can make all the rookie mistakes you want with forex trading on a demo account first, without risking any of your actual money, until you gain more confidence.

Hi there, I log on to your blog daily. Your story-telling style is witty, keep it up!| а

Forex made easy. thanks boss

For latest news you have to pay a quick visit world wide web and on web I found this site

as a best web page for newest updates. adreamoftrains content hosting

What a information of un-ambiguity and preserveness of valuable know-how concerning unpredicted feelings.|

Its like you learn my thoughts! You appear to grasp a lot about this, like you wrote the book in it or something. I feel that you just could do with a few to power the message home a bit, however other than that, that is magnificent blog. A fantastic read. I’ll definitely be back.|

I am not certain the place you are getting your information, however good topic. I needs to spend a while finding out much more or understanding more. Thanks for fantastic info I used to be in search of this info for my mission.|

What’s Taking place i’m new to this, I stumbled upon this I have discovered It absolutely helpful and it has aided me out loads. I am hoping to contribute & help other users like its aided me. Great job.|

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is fundamental and everything. But just imagine if you added some great images or videos to give your posts more, “pop”! Your content is excellent but with pics and video clips, this website could definitely be one of the very best in its niche. Fantastic blog!|

Very nice post. I simply stumbled upon your blog and wanted to say that I have really loved browsing your weblog posts. After all I will be subscribing for your rss feed and I am hoping you write again very soon!|